IIPM - Admission Procedure

He’s got a taste for all the good things in life. But this maverick is not all play and no work. Look how he’s astutely giving wings to his high spirits...

Hic!

‘Never mix drinking and driving’... a cliché prudent men have harped upon since time immemorial; a cliché Vijay Mallya follows to the T... the reason he so fervently mixes drinking with... flying! Oh well, that’s an old one, isn’t it? You knew that already, didn’t you?! But did you also know that this ‘alcohol’ maverick is referred to by the industry as the ‘King of Good Times’? And for those who choose to be ignorant (given the hype with which he intelligently promoted the fact), the ‘liquor lord’ is already a doctor (‘Dr.’ Vijay Mallya, if you please) – someone who you stand a fabulous chance of overhearing in smokefilled upscale parties at ungodly hours swankily meeting beau monde Page 3 personalities, someone who you might catch posing on photo-shoots with ‘bedazzlingly’ beautiful landscapes... or foxy supermodels... or both (and necessarily in the reverse order!) or standing assertively in front of a ‘Kingfisher’ aircraft, grinning the café society glitterati smile, or even guffawing away with faddy guests on Fashion TV! Did someone also mention you’ll see him doing business?! Oh yes, he also does that! That just about summarises the mercurial personality that is Vijay Mallya, an exemplary industrialist who’s more known amongst oh-so-common-people for his swish presence in the social circuit than for his proven and everpresent spectacular business acumen! But perchance all that is well in the fabled past, given that India’s global liquor baron now effectively holds the reins of two of India’s fastest growing airlines, and much of it due to his own astounding undoing, with the most recent 26% coup of a stake-buyout in Air Deccan for Rs.5.5 billion!

‘Never mix drinking and driving’... a cliché prudent men have harped upon since time immemorial; a cliché Vijay Mallya follows to the T... the reason he so fervently mixes drinking with... flying! Oh well, that’s an old one, isn’t it? You knew that already, didn’t you?! But did you also know that this ‘alcohol’ maverick is referred to by the industry as the ‘King of Good Times’? And for those who choose to be ignorant (given the hype with which he intelligently promoted the fact), the ‘liquor lord’ is already a doctor (‘Dr.’ Vijay Mallya, if you please) – someone who you stand a fabulous chance of overhearing in smokefilled upscale parties at ungodly hours swankily meeting beau monde Page 3 personalities, someone who you might catch posing on photo-shoots with ‘bedazzlingly’ beautiful landscapes... or foxy supermodels... or both (and necessarily in the reverse order!) or standing assertively in front of a ‘Kingfisher’ aircraft, grinning the café society glitterati smile, or even guffawing away with faddy guests on Fashion TV! Did someone also mention you’ll see him doing business?! Oh yes, he also does that! That just about summarises the mercurial personality that is Vijay Mallya, an exemplary industrialist who’s more known amongst oh-so-common-people for his swish presence in the social circuit than for his proven and everpresent spectacular business acumen! But perchance all that is well in the fabled past, given that India’s global liquor baron now effectively holds the reins of two of India’s fastest growing airlines, and much of it due to his own astounding undoing, with the most recent 26% coup of a stake-buyout in Air Deccan for Rs.5.5 billion!“I often joke that the

other air carriers should pay us because we’ve done them a favour (by taking over Air Deccan)!” Mallya plays his character to the hilt talking exclusively to 4Ps B&M spouting shrewd logic hidden underneath ostensible humour! Through his years, loaded Mallya has brilliantly earned the atypical right to be what he is! They say there is a long dirge-ridden story behind every billionaire, of disadvantaged childhoods, of misery-ridden struggles, of pained upbringings, of... stop right there! Phew... Going against expected thought, it’s pleasurable for a change to see that Mallya, despite normal tribulations, ‘was’ born with a golden spoon in his mouth! This stylish tycoon learnt to live by the sword very early on in life when he was given the charge of United Spirits as the Executive Chairman way back in 1983 when his father (who had bought United Breweries in 1947 and McDowell’s half-a-decade later) unfortunately expired.

other air carriers should pay us because we’ve done them a favour (by taking over Air Deccan)!” Mallya plays his character to the hilt talking exclusively to 4Ps B&M spouting shrewd logic hidden underneath ostensible humour! Through his years, loaded Mallya has brilliantly earned the atypical right to be what he is! They say there is a long dirge-ridden story behind every billionaire, of disadvantaged childhoods, of misery-ridden struggles, of pained upbringings, of... stop right there! Phew... Going against expected thought, it’s pleasurable for a change to see that Mallya, despite normal tribulations, ‘was’ born with a golden spoon in his mouth! This stylish tycoon learnt to live by the sword very early on in life when he was given the charge of United Spirits as the Executive Chairman way back in 1983 when his father (who had bought United Breweries in 1947 and McDowell’s half-a-decade later) unfortunately expired.So there was this twenty-seven yearold, young, ultra-aggressive freemartin bohemian, whose neophyte decision- making capacity was critically questioned, not only by the ever scowling media, but also by the very peers who had earlier loquaciously supported the ‘son’ Mallya. But the novitiate Mallya, not satisfied with what he was bequeathed, innovated, and innovated fanatically! “Look at my products, be it beer, vodka, whiskey, rum, whatever it is. I always refresh my products. I don’t go to sleep saying that I have a winner here... That is where I caught my competitors napping,” Mallya once boasted to media.

The ‘tipping’ point definitely occurred in March 2005, when Vijay Mallya furnished an irresistible Rs.15.45 billion offer as a consideration for gaining a stranglehold 75% control in voting power in Shaw Wallace & Co., which Vidya Chhabria (wife of late Manu Chhabria) and her three daughters found hard to resist! The deal marked the end of a tormenting twenty-year-old saga to gain control over Shaw Wallace between the camps of Vijay Mallya and Manu Chhabria.

Add to this the control gained over Herbertsons (from friend-turned-foe Kishore Chhabria) and by late 2006, Mallya’s arsenal was sparkling with a total of 140 world-class liquor brands, which included 12 ‘million-dollar’ brands! After snapping up Shaw Wallace & Co. in a style most crafty, he went ahead and ingeniously added the stamp of Whyte & Mackay for $1.2 billion on May 21, 2007, the fourth-largest Scotch whiskey producer in the world (it produces 10% of the total global production of Scotch whiskey) – to the UB stable.

But isn’t it true that the sales of Scotch are falling or stagnating in the biggest markets across North America and Europe? Isn’t it also true that due to prohibitive import duties (550% on foreign spirits), less than 1% of whiskey consumers in India and China consume Scotch? Interestingly, not only are all of these true, but these are the very same facts that Mallya is betting on! With 2012 being the year when India does away with all the above-mentioned duties (as per WTO, of which India is a signatory), Mallya’s return on investment seems to have been guaranteed from the moment the cork was unscrewed from the whiskey bottle. Cut to the present! The holding company United Spirits, with sales revenues totalling a mind-boggling Rs.33.41 billion, with market capitalization reaching Rs.110 billion, and a gargantuan volume of 65,000 million cases during 2006 alone, is now the world’s 2nd largest liquor brewer!

But again, what about the deadly mix of drinking and flying? Isn’t it a fact that Kingfisher Airlines, despite being gifted with increasing passenger load, has been suffering mammoth losses, quarter after quarter? How sensible is the Air Deccan stake purchase in this scenario? Extremely sensible and spectacularly well-timed, is the answer! Mallya knew all along that unless there is consolidation in the industry, the price wars between discrete players will only end up destroying all of them. In fact, not many know that Mallya was one of the first bidders for Air Sahara!

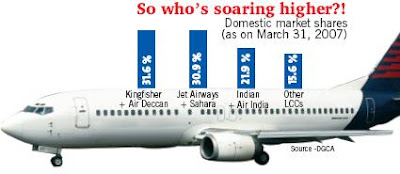

Not surprisingly, the fact is that currently all (yes, all) players in the airlines industry are in losses. Mallya mirrored this thought to 4Ps B&M, “There will be rationalisation in the industry. With this ‘sweetheart’ deal, Kingfisher Airlines and Air Deccan will work closely to exploit the unparalleled significant synergies that exist in the areas of operations, maintenance, connectivity, feeder services et al. The Kingfisher-Air Deccan combine will be the largest domestic airline with a market share of 31.6% and 537 daily flights covering the single largest network in India connecting 69 cities.”

Even G.R. Gopinath, MD, Air Deccan told 4Ps B&M that “UB was preferred over other interested investors, due to the inherent synergies. Air Deccan would continue to operate as an independent airline with increased focus on the low cost business model... We foresee sharing of infrastructure, resources and best practices between both the airlines.”

What they both left cleverly unsaid was that from being price warriors, the new quasi-monopoly with 73 aircraft would define a new age of rising air ticket prices; a point one suspected when Mallya vehemently told 4Ps B&M, “I don’t think that any consumer can expect to get a deal where the provider is at a loss!”

The classy strategic shrewdness of Mallya comes out with the fact that his closest competitor, Jet Airways, despite having a super 30.9% marketshare, is in deep doldrums, and all due to Naresh Goyal’s horrendously inane Rs.19.5 billion takeover of Air Sahara. To think about it that Mallya just paid Rs.5.5 billion for becoming the industry’s number 1! More hitting is the fact that unlike bamboozling CEOs of the current Indian airlines industry, who’re falling over each other to purchase more and more aircraft, Mallya, compellingly, is adding only 5 more A340s-350s to his fleet by 2008 and 5 more A380s by 2010.

And it is quite evident that Mallya has displayed this kind of a thrillingly radical competitive thought through all his businesses, with a clear focus of one day emerging as a global leader.

So, there we are – a story of a simple father passing on his liquor baton to his grandiose son who has ensured that the sceptre he waves over his kingdom is more than just a champagne bottle. It’s not surprising that more than 50% of his Group’s revenues today come from investments made in aviation, pharmaceuticals, agro-chemicals, electro-mechanical batteries, food products and carbonated beverages and many other smallscale industries!

This, ladies and gentlemen (well, at least all those above the legal drinking age limit), is the start of perhaps India’s most flamboyant business tale in years to come! And this, perhaps again, is also the start of an empire that the world will one day call iconoclastic... Victoriously iconoclastic! Well, isn’t ‘victory’ actually the first name of ‘Vijay’ Mallya?

Indian Virgin?

He doesn’t own a mobile phone company, a record label or even a night club yet, but some have grudgingly begun calling Vijay Mallya ‘India’s Richard Branson’ ever since he took his Kingfisher beer brand into airlines in 2005. Branson, the maverick British entrepreneur, is best known for his Virgin brand, straddling over 350 companies and verticals, including Virgin Atlantic Airways, Virgin Vodka, Virgin Records, Virgin Mobile, et al.

Walk into any of Kingfisher’s spanking new aircrafts and you’re sure to get that suspicious feeling that you’ve walked straight into a Virgin Atlantic aircraft, the ambience is strikingly similar, right from the red jacket and skirts worn by the chic and svelte Kingfisher cabin crew, to the seat-back personal TV sets. The business similarity between the two flamboyant tycoons does not end only with their respective alcoholic beverage and aviation businesses. No sir! The fun, good times, and a spirited sense of competitive challenge seemingly drives every aspect of both their businesses.

The dashing and ostentatious lifestyles of both these mediasavvy personalities also share uncanny similarities. Both like to travel a lot; have a thing going for yachts and page 3 people, apart from a keen love for anything out-of-the box. In fact, with their debonair, swashbuckling personas, both serve as perfect brand ambassadors for Virgin and Kingfisher, respectively.

Only thing perhaps: Branson could pick up another liquor company or two, and Vijay Mallya could start a hot air balloon journey around the world... (with or without companions, that is).

For Complete IIPM Article, Click on IIPM Article

Source : IIPM Editorial, 2008

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

For More IIPM Info, Visit Below....

IIPM - Admission Procedure

Why Study Abroad When IIPM Gives You 3 global Advantages!

The Sunday Indian - India's Greatest News weekly

IIPM, ADMISSIONS FOR NEW DELHI & GURGAON BRANCHES

IIPM, GURGAON

ARINDAM CHAUDHURI’S 4 REASONS WHY YOU SHOULD CHOOSE IIPM...

IIPM Economy Review

No comments:

Post a Comment